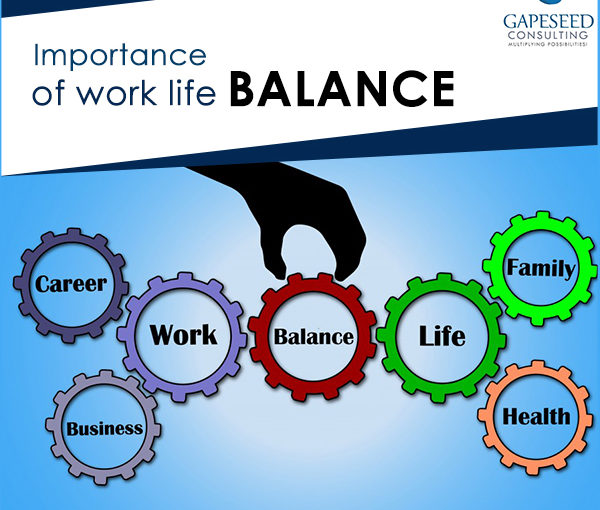

WHAT IS WORK LIFE BALANCE?

Work life balance is all about creating and supporting a healthy work environment which will enable a worker to have balance between work and personal responsibilities. This will help in maintaining and strengthening employee loyalty and productivity towards the company. Workers have many responsibilities to take care of, such as work, family, housework and many more little things that matter to them. Balancing between work and life has become a major issue between workers as this conflict has been associated with numerous physical and mental health problems. Work-life conflict impacts workers, employees and their communities as well. A worker can only be productive when there is balance between its work and life.

COMPONENTS OF WORK-LIFE BALANCE

TIME MANAGEMENT

Time management is one of the major components to achieve work life balance. It is a way of organizing and planning effectively the time required to complete certain activities, it also helps in efficient use of your day. Time management can be done on the basis of your work, whether it is urgent or important. It helps in greater productivity and efficiency, less stress and better professional reputation.

STRESS MANAGEMENT

Stress management is a technique to reduce stress suffered by workers. As the world is growing and changing faster every day, work becomes more complex over time. Competition arises between workers to excel in the company. Workers then start working under pressure of promotion and preference, this results in stress of work. Workers must not come under stress while working rather than stressing over deadlines.

SELF-MANAGEMENT

Self-Management is a way of managing one own self. A worker must take care of its body, hygiene and nutrition. A worker must develop talents and potential to enhance their quality of life. A worker must get enough sleep and exercise to be productive and work effectively and efficiently for a company. If a worker excels in managing one own self, then they will become more capable of managing tasks.

CHANGE MANAGEMENT

In this growing world, change has to be adopted no matter whatever the consequences may be, continuously adopting new methods and re-adapting others is vital to a successful career and a happy home life. Effective change management involves making certain changes in your work and everyday life.

IMPROVING WORK-LIFE BALANCE

Role of an Employer

An employer must direct an employee towards the organisational goal and support them by providing them with necessary resources. Employers can arrange special workshops on this major issue and also programmes, initiatives for the betterment of the employees. Here are some decisions an employer must take to eradicate this problem.

Employer must see to it that the employee is not given any extra work after they have left their worksite. It means restricting number of hours which are expected of an employee in a given week. They should also see to it that their e-mail servers should stop after the working hours.

Employers must concentrate more on the outcome rather than the number of hours a working is working. A productive worker can complete its worker well before 8 hours and may not need to waste time.

They should also increase number of brakes while working, keeping in mind the stress factor of an employee. Lunch breaks, rest breaks must also be kept in mind while making such decisions. Also; providing breaks to workers increase their productivity which means effecting work.

Employer must also inform its workforce regarding work-life balance and its importance. This will help them in taking extra care of themselves and their families, resulting in less health problems both physically and mentally.

An employer must let the employees do certain things which make them happy and satisfied at work. This will help the employee in improving its mental state by providing them with happiness.

Getting inputs and feedback from employees keeps them connected to the company and makes them feel that they are a vital part of the organisation. This will keep them motivated and satisfied while working for the betterment and growth of the company.

Motivating its employees by fulfilling their basic needs, social needs and esteem needs. An employer must appreciate the work done by its employees and guide them if they go wrong.

Understanding the needs and problems of a worker must be kept in mind. Offering maternity leaves to new parents will help the employees to feel better about the organisation and make them believe that the organisation really do care for them.

The organisation must also provide employees with more number of vacation days so that they get to spend more time with their family and help them self-manage themselves.

Some examples of good work life balance in the world are:

1. Family is given more importance than work in the Danish Culture. The country focuses on fewer working hours so that workers get more time to spend with their families.

2. In Madrid, workers are allowed to have mid-afternoon breaks to avoid the sun and this cuts down their hours substantially.

3. Workers in Germany take an average of 29 days’ holiday every year just to celebrate Oktoberfest and be with their families.

4. In France, workers get mandatory pay leaves of 40 days and the government is forcing them to not use smart devices after work hours, also no checking and responding to e-mails after work.

5. In Netherlands people work an average of 27.6 hours a week. It is one of the few countries in the world to have such a low work week cycle but yet they have a very good GDP. It is also said that Netherlands has a 4-day work week.

6. Bulgaria is the best place for the people to work in who have kids as, the workers are given up to 410 days of paid maternity leave at 90 percent of the mother’s salary.

Work-Life balance is very important in a workers’ day to day activities as performing certain tasks may drain out their energy of doing other tasks for their family or for themselves. Balancing will help a worker to be productive and grow as a person. Good management of time, stress and change in the environment by an employee leads to effective and efficient work.

For more information on WORK LIFE BALANCE, feel free to reach us on, info@gapeseedconsulting.com or call +91-9599444639/+91-9599444630

More Newsletter

The Evolving Role of Internal Audit in Growing Companies

Save Tax through the following Tax Exemptions