The forms for the (ITR) Income Tax Return for Financial Year 2015-2016 i.e. Assessment Year 2016-2017) have been released by the Income Tax Department. These are applicable for your income tax

return for income earned from 1st April 2015 to 31st March 2016.

If you’re looking forward to get some assistance on filing your Income Tax Return Gapeseed Consulting can help you with knowing different ITR Forms and filing the same. You could read more on our website here.

To figure out which ITR you need, read below to know more.

ITR-1

The following people need this return form whose total icome for the assessment year 2015-2016 include

- Income from Salary/Pension

- Income from One House Property

- Income from Other Sources which does not include Winning from Lottery and Income from Race Horses

Who cannot use this Return Form

If you own any asset for any financial interest or have an account located outside India you cannot use this return form also if you have exempt income which is more than Rs. 5,000, you cannot use ITR-1.

ITR-2A

This tax return form can be used under the given condition:

- Income from salary and has more than one house property but does not have any capital gains.

- People with long term capital gains securities on which transaction tax is paid.

- NRIs if they do not have any foreign assets.

If you fall under any of the category below you cannot file through ITR 2A

- If income is from capital gains

- Income from Business

- If you have claim of relief/deduction under section 90, 90A or 91

- If you have any asset which lies outside India.

- If you have an earning source outside India.

ITR-2

If you lie under the category of Hindu undivided family you need to file your tax by filling up ITR-2 under the following circumstances:

- If the Income is from Salary/Pension

- Income earned from house property

- Income from Capital Gains

- Income from Other Sources which includes winnings from Lottery and income from Race Horses.

The Return Form should not be used by an individual whose total income for the assessment year 2015-16 includes Income from Business or Profession or if you receive remuneration as a Partner in a Partnership Firm or LLP. If you lie among anyone if the following categories you need to declare these types of incomes under ITR-3, ITR 4 or ITR-4S.

ITR-3

This Return Form is to be used by an individual or an Hindu Undivided Family who is a partner in a Partnership Firm or LLP and where income chargeable to income-tax under the head, profits or gains of business or professional does not include any income except the income by way of any interest, salary, bonus, commission or remuneration, by whatever name called, due to or received by them from such firm.

Only this form is to be used in case a partner in the firm does not have any income from the firm by way of interest, salary, etc. and has only exempt income by way of share in the profit of the firm and not Form ITR-2.

If your total income is from Business or Profession under any proprietorship then this Return Form should not be used.

ITR-4S OR SUGAM

This Income tax Return to be filed by individuals, HUF and small business taxpayers having presumptive business income, salary/pension, one house property or income from other sources.

You cannot use this form if the individual has more than one house property, speculative income, agriculture income more than Rs 5000, capital gains.

ITR-4

For individuals and HUFs having income from a proprietory business or profession.

ITR-5

For firms, LLPs, AOPs (Association of persons) and BOIs (Body of Individuals)

ITR-6

For Companies other than companies claiming exemption under section 11 (Income from property held for charitable or religious purposes)

This return has to be filed electronically only.

ITR-7

For persons including companies under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D).

- Return under section 139(4A) is required to be filed by every person in receipt of income derived from property held under trust or other legal obligation wholly for charitable or religious purposes or in part only for such purposes.

- Return under section 139(4B) is required to be filed by a political party if the total income without giving effect to the provisions of section 139A exceeds the maximum amount which is not chargeable to income-tax.

- Return under section 139(4C) is required to be filed by every

- scientific research association;

- news agency ;

- association or institution referred to in section 10(23A);

- institution referred to in section 10(23B);

- fund or institution or university or other educational institution or any hospital or other medical institution.

- Return under section 139(4D) is required to be filed by every university, college or other institution, which is not required to furnish return of income or loss under any other provision of this section.

Click here to drop us a line if you have any questions regarding tax filing online.

More Newsletters

Save Tax through the following Tax Exemptions

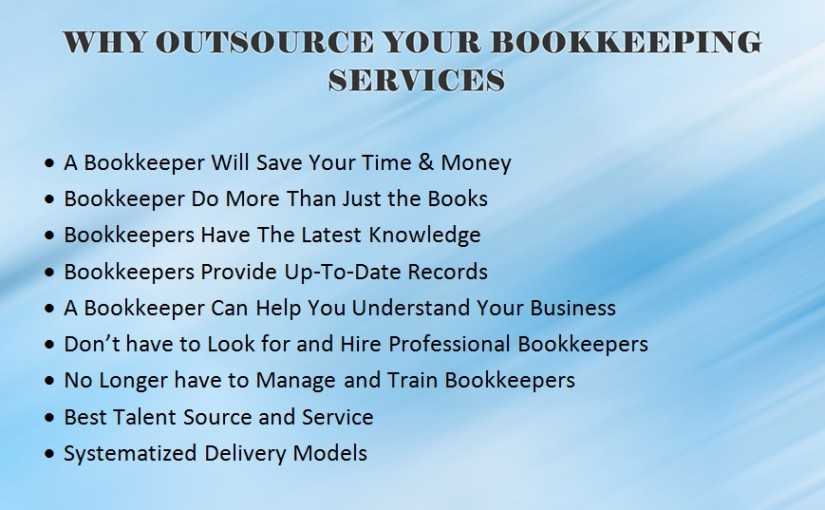

Outsource Bookkeeping Services and Simplify Taxation

9 most important Income tax changes which will occur from 1st April